This article is about how the new tax bill changes personal taxes. If you want to know the types of changes that have been made to anesthesiologist business taxes click here.

On December 20, 2017, Congress passed a new tax bill that has been touted “the most sweeping tax overhaul in 31 years.” Ever since the bill’s passage, we have been getting tons of questions about how the new tax bill will impact the take-home for high earning individuals, like anesthesiologists.

The new tax bill is the biggest tax overhaul in 31 years.

Navigating the 600-page bill is an incredibly daunting task (not to mention time-consuming waste of time), so we hosted a webinar to review everything that impacts anesthesiologists. We also answered some of the most common questions anesthesiologists have about how they can maximize the benefits and minimize the downside of the new tax bill.

You can jump straight to the webinar recording…or just keep reading to learn about the most important aspects of the new tax bill that impact your personal taxes.

Some Basics About the New Tax Bill

One of the most important things to note is that the tax cuts for individuals will expire in 2025. In addition, although these tax laws have been written and approved, we do not yet know how they will be interpreted. The regulating bodies that writes the implementation regulations and guidelines have not yet released much information, therefore, our understanding of how the new tax bill will impact anesthesiologists may change as guidelines are released.

Sign up here for updates as new regulations are released to understand exactly how the new tax bill will impact your 2018 personal taxes and what you can do to minimize them.

In order to better understand the tax bill changes it is important to understand the following terms:

- Adjusted gross income (AGI) = all income (wages, interest, dividends, other business income, etc.) – adjustments (business expenses, HSAs, self-employed insurance deductions, etc.)

- Taxable income = adjusted gross income – standard or itemized deductions (whichever is higher)

Geography Matters

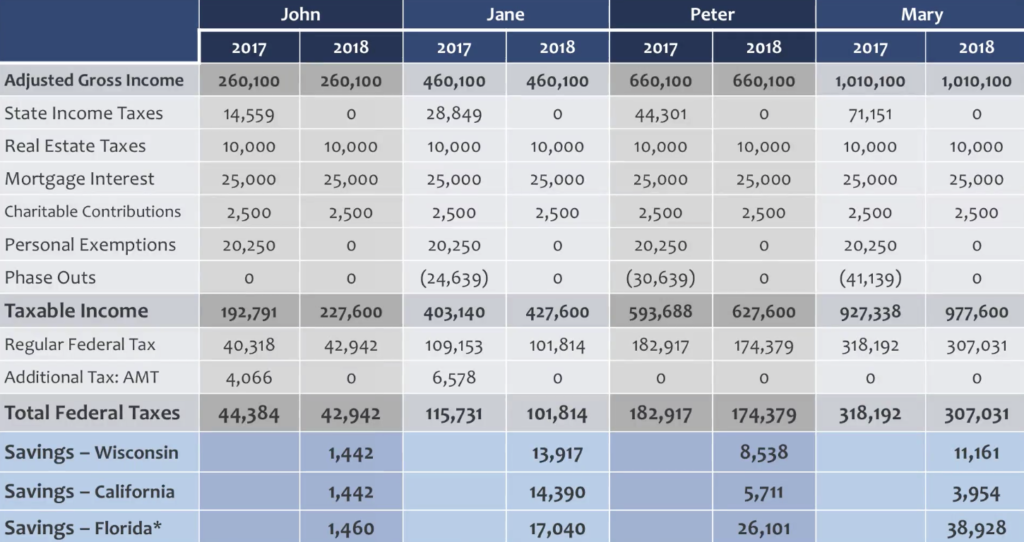

Where an individual or joint filling couple lives will have a huge impact on how much the new tax bill will save (or cost) them. Generally speaking, low tax state residents will generally benefit immensely, while high tax state residents much less so. Similarly, medium and higher earning anesthesiologists will tend to do better than lower paid or part-time anesthesiologists. However, the details of your situation matter: the size of your total income, whether you rent or own your house, your spouse’s earnings, etc can have a big impact.

As you can see in the following example, while the savings are similar for John’s relatively low salary regardless of his location, Mary’s high earnings create a tax savings that differs by almost $35,000 depending on whether she is filing from California or Florida.

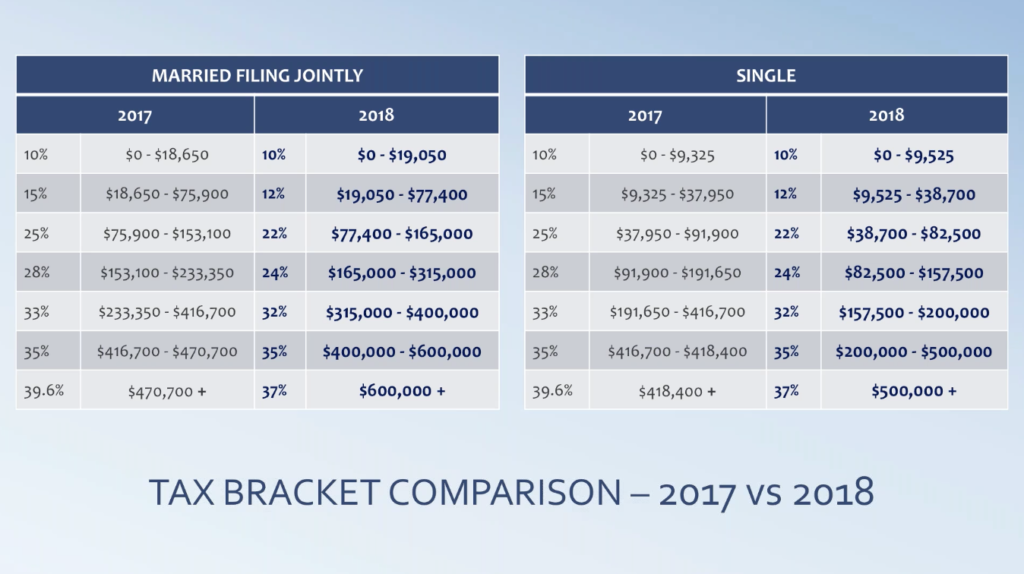

Modified Tax Brackets

The new tax bill redefined the tax brackets and recalculated how the alternative minimum tax comes into play. Although the number of tax brackets remains the same (seven) the minimums and maximums have been shifted to be lower overall with the highest bracket at 37% rather than the previous 39.6%. The “married filing jointly” tax brackets continue to be double the amount of the “single” brackets except for the two highest categories.

Tax cuts for individuals expire in 2025.

Personal Deductions and Exemptions

Individuals can claim personal deductions and exemptions for themselves and each dependent, but with many anesthesiologists making over 300k, these deductions began phasing out and were eliminated for those making over 430k.

Changes have been made to the standard deductions, in hopes of simplifying tax filings for individuals who previously itemized their deductions. Of course, this has the side effect of making it harder to get to a deduction level where itemization is advantageous.

Personal Itemized Deductions

Schedule A itemized deductions have also been changed:

- Medical and dental expenses: The ability to deduct medical expenses has been changed. Previously, medical expenses had to cost more than 10% of AGI to qualify for the deduction. This has now been reduced to 7.5%, however, most anesthesiologists don’t get to take advantage of this deduction. Because of their high-income level, they would need to be spending tens of thousands of dollars out of pocket to get to the required 7.5% of income.

- State, local, and property taxes: These deductions are remaining in place, however, they are becoming more limited with a max deduction of $10k. Previously there was no limit in this area. (Individuals who file using a schedule C, E, or F may still be able to use these deductions with a higher limit).

- Mortgage interest: The new tax bill limits the loan amounts for which mortgage interest can be claimed to $750k (previously $1m) and partly repeals the deduction that could be taken for home equity loans (HELOC). HELOCs are now only deductible under certain conditions and if the mortgage and HELOC combined is under $750k.

- Charity gifts: The income-based limit of contribution has been increased from 50% to 60% and denies charitable deductions for donations in exchange for college athletic event seating rights (season tickets).

- Job expenses and miscellaneous (subject to 2% floor): All have been repealed including unreimbursed employee business expenses, dues, job search expenses, tax prep fees, and investment management fees.

- Pease limits: Pease limits have been repealed. Previously, if your income was higher than $314k your itemized deductions are reduced by 3% of your AGI in excess of the limit.

The Alternative Minimum Tax (AMT)

The shift in tax brackets and changes to deductions also impacts what is known as the Alternative Minimum Tax. This tax was created in 1969 to ensure that wealthy filers could not utilize so many loopholes and deductions to avoid paying any taxes. This forced virtually everyone, regardless of income level, to pay at least some taxes by eliminating certain deductions and taxing at a flat 26% or 28% rate.

The shift in tax brackets and changes to deductions also impacts what is known as the Alternative Minimum Tax. This tax was created in 1969 to ensure that wealthy filers could not utilize so many loopholes and deductions to avoid paying any taxes. This forced virtually everyone, regardless of income level, to pay at least some taxes by eliminating certain deductions and taxing at a flat 26% or 28% rate.

The AMT was established in 1969 but has never been indexed for inflation.

Even though the AMT was established almost 50 years ago it was never indexed for inflation. As a result, as more Americans began to make higher incomes, more and more people were forced to pay this tax. Households making between $200k and $500k were forced to pay this tax. Filers with high state income taxes, real estate taxes, personal exemptions, and deductions paid, were most likely to be hit by AMT.

The new tax bill now calculates where this tax must be paid using the following guidelines when it comes to preference items:

- Eliminates personal exemptions

- Limits real estate taxes

- Limits state taxes

- Eliminates the 2% miscellaneous deductions

These have been implemented into the regular tax calculations, significantly reducing the number of people that will be impacted.

It’s less likely that you will have to pay AMT under the new tax law.

Miscellaneous Credits, Exemptions, and Deductions

In addition to changes that impact common elements of personal tax, there are also a few other miscellaneous changes that have been implemented that have garnered a lot of questions. Here are some of the most common changes we have been asked about:

- Child tax credit: In the new tax bill the child tax credit has been significantly increased on all fronts. It has been doubled from $1k to $2k (per eligible individual/child) and with a potential $1.4k refundable. The income limitation phase-out has been increased to $400k, allowing more household to be able to take advantage of the credit.

- Credits for non-child dependents: Individuals can now claim a $500 non-refundable credit per eligible non-child dependent. This new credit is particularly helpful for children of baby boomers who may be supporting their own parent, an in-law, or sibling with living expenses.

- Alimony deductions or inclusions: This is a permanent change that only impacts future and in-process divorces. A previous provision allowed alimony payments to be deducted from the payer and included as income by the payee. This has been repealed meaning divorced couples will no longer be able to spread income between the two households to play the brackets for other tax loopholes. If couples want to take advantage of this alimony deductible the agreement has to be dated and filed before the end of 2018.

- ACA individual mandate: This mandate was put in place for individuals who didn’t have adequate health insurance, whether they didn’t have any coverage or didn’t have “sufficient” coverage. This mandate will be partially repealed starting on January 1, 2019.

- “Kiddie tax”: This tax was paid by children who had unearned income, or investment income. Previously, this income was taxed at the marginal rate of their parents and filed with their parents’ taxes. Moving forward, minor’s returns can be filed separately and taxed using the trust and estate tax rate (independent of the parents’ marginal tax rate).

- Estate tax exemptions: The estate tax exemption had been previously benchmarked at $5m per person as of 2011 and then indexed for inflation since then. Under the new tax bill, they returned to the 2011 rate, doubled the exemption, and are in the process of indexing to change the exemption rate to approximately $11.2m per person. Keep in mind that although the exemption has been doubled, the estate tax rate has not

Still Have Questions?

We provide both personal and business tax preparation and planning services as part of our full-service approach to billing services for anesthesiologists and anesthesia practices.

We provide both personal and business tax preparation and planning services as part of our full-service approach to billing services for anesthesiologists and anesthesia practices.

If you want to know what kinds of changes have been implemented for businesses, check out How the New Tax Bill Impacts Anesthesiologists’ Business Taxes.

For more details about the tax changes, watch the complete webinar replay. We will be updating this blog as new regulations are released that explain some of the specifics of how these new tax laws will actually be implemented and enforced by the IRS. Once enough regulations have been released for us to build a better tax planning framework for anesthesiologists, we will put out a new tax planning webinar… just for anesthesiologists… as always.

Sign up for tax planning updates

Or, if you have specific comments or questions, feel free to contact us directly.